Dividend yield is one of the most important metrics for investors—especially those seeking a steady income stream from their investments. In today’s dynamic financial landscape, understanding dividend yield helps you gauge the income potential of your stock portfolio and make more informed investment decisions. This guide will break down what dividend yield is, how it’s calculated, why it matters, its advantages and limitations, and how to use it effectively in your investment strategy.

Table of Contents

Introduction

Imagine owning shares in a company and receiving a regular payout simply for holding onto those shares. That’s the promise of dividend-paying stocks. Dividend yield is the key metric that tells you how much cash income you can expect relative to the price you pay for the stock. For income-focused investors—such as retirees or those seeking to supplement their earnings—dividend yield plays a central role in building a portfolio that not only grows over time but also provides a reliable source of income.

Also Read: Demystifying Demat Accounts: Unlocking the Future of Digital Investing

This article provides an in-depth look at dividend yield. Whether you’re a seasoned investor or just beginning your journey, you’ll gain a clear understanding of how to interpret dividend yield figures and apply them to your investment strategies.

What Is Dividend Yield?

At its simplest, dividend yield is the ratio of a company’s annual dividend payment per share to its current stock price, expressed as a percentage. It represents the return an investor can expect to receive in the form of dividends relative to the investment’s cost.

Key Definition

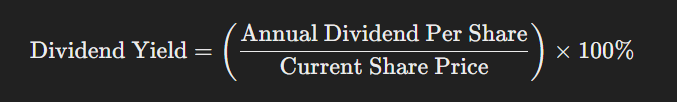

- Dividend Yield Formula:

For example, if a company pays an annual dividend of $2.00 per share and its current stock price is $50.00, the dividend yield is:

Trailing vs. Forward Dividend Yield

- Trailing Dividend Yield uses dividends paid over the past 12 months.

- Forward Dividend Yield estimates future dividend payments based on company guidance or analyst forecasts.

Understanding both helps investors assess whether the current yield is sustainable and how it might change in the future.

How to Calculate Dividend Yield

Calculating dividend yield is straightforward if you have two key pieces of information: the annual dividend per share and the current share price.

Step-by-Step Calculation

- Determine the Annual Dividend:

If dividends are paid quarterly, multiply the latest quarterly dividend by four. - Find the Current Share Price:

Use the most recent trading price. - Apply the Formula:

Divide the annual dividend by the share price and multiply by 100 to get a percentage.

Example Calculation

- Company XYZ:

- Quarterly Dividend: $0.50

- Annual Dividend: $0.50 × 4 = $2.00

- Current Share Price: $50.00

Quick Tips

- Consistency: Always use the same period (e.g., trailing twelve months) when comparing yields.

- Adjust for Special Dividends: Exclude one-time payments to assess sustainable yield.

- Use Reliable Sources: Data from company filings or trusted financial websites ensure accuracy.

The Significance of Dividend Yield

Why It Matters

Dividend yield provides insight into:

- Income Generation: It tells you how much cash income you can expect relative to your investment.

- Valuation Indicator: A high yield might indicate an undervalued stock or signal that the stock price has fallen due to underlying issues.

- Comparative Analysis: Investors can compare yields across companies in the same sector to identify attractive income opportunities.

Role in Investment Strategy

For investors focused on generating regular income, dividend yield is a crucial tool:

- Retirees and Income Investors: Rely on dividends as a primary income source.

- Dividend Growth Investors: Look for companies that not only pay dividends but also increase their payouts over time.

- Total Return Analysis: Dividend yield is one component of total return, which also includes capital gains.

Advantages of Using Dividend Yield

Dividend yield offers several benefits for investors:

- Simplicity:

The formula is easy to understand and calculate. - Income Measurement:

It directly reflects the cash income you receive from an investment. - Comparison Tool:

Helps compare income potential across stocks, sectors, or even with other income-generating investments like bonds. - Screening Metric:

Investors can use dividend yield to quickly screen for stocks that fit their income strategy.

Limitations and Considerations

While dividend yield is useful, it has its drawbacks:

- High Yield Caution:

A very high dividend yield might indicate a declining stock price, which could be a warning sign of financial distress. - Yield Doesn’t Tell the Whole Story:

It does not account for capital gains or losses. A stock with a low yield might still offer strong total returns if its price appreciates significantly. - Sustainability:

Yields can fluctuate if companies change their dividend policies. It’s important to assess the consistency and history of dividend payments. - Market Conditions:

Economic downturns or interest rate changes can impact both stock prices and dividend payouts, affecting the yield.

Dividend Yield in Investment Strategies

Dividend Growth Investing

Investors following dividend growth strategies focus on companies that have a track record of consistently increasing their dividends. This approach not only provides income but also helps combat inflation over time. Examples include established companies like Johnson & Johnson and Coca-Cola, which have demonstrated stable dividend increases over decades.

Income Investing

For those prioritizing immediate cash flow, high-yield dividend stocks are attractive. However, sustainability is key—investors must ensure that high yields are supported by strong cash flow and manageable payout ratios.

Diversification

It’s essential to diversify across sectors:

- Utilities and Consumer Staples: Typically offer stable, moderate yields.

- Real Estate Investment Trusts (REITs): Often provide higher yields but can be more sensitive to interest rate changes.

- Financials and Energy: Yield levels vary significantly; careful analysis is required.

Incorporating Dividend Reinvestment

Reinvesting dividends can compound returns over time. Many investors opt for dividend reinvestment plans (DRIPs) to purchase additional shares, enhancing both income and capital gains in the long term.

Real-World Examples and Data

Let’s look at a few well-known U.S. companies to illustrate dividend yield in practice. Below is a sample table of selected dividend-paying stocks with their approximate figures:

| Company | Current Price (USD) | Annual Dividend (USD) | Approx. Dividend Yield (%) |

|---|---|---|---|

| Johnson & Johnson (JNJ) | 165.02 | ~$4.00 (estimate) | ~2.4% |

| Coca-Cola Co (KO) | 71.21 | ~$1.80 (estimate) | ~2.5% |

| Apple Inc (AAPL) | 241.84 | ~$0.88 (estimate) | ~0.4% |

| Microsoft Corp (MSFT) | 396.99 | ~$2.00 (estimate) | ~0.5% |

Note: The dividend figures are approximate estimates based on recent historical data and may vary with future announcements.

These examples show that even large, well-established companies might offer modest yields. In contrast, some companies—especially in sectors like utilities or REITs—can offer higher yields, making them attractive for income investors.

Interpreting Dividend Yield

What a “Good” Yield Means

A good dividend yield depends on several factors:

- Industry Norms: Yields in utilities might be higher than in technology.

- Company Health: A moderate yield in a company with a strong track record of dividend growth is usually more attractive than a very high yield from a struggling firm.

- Economic Environment: In a low-interest-rate environment, even modest dividend yields can be appealing relative to bond yields.

Complementary Metrics

Dividend yield should not be used in isolation. Other important metrics include:

- Dividend Payout Ratio: The proportion of earnings paid out as dividends. A very high ratio may indicate limited reinvestment in the business.

- Earnings Growth: Indicates the potential for future dividend increases.

- Free Cash Flow: Ensures the company has enough cash to sustain its dividend payments.

Qualitative Factors

In addition to quantitative analysis, consider:

- Management Quality: Their commitment to dividend policy.

- Market Position: How well the company can maintain competitive advantages.

- Industry Trends: Sector-specific risks and opportunities.

FAQs

What Is Dividend Yield and Why Is It Important?

Dividend yield is the annual dividend payment divided by the stock’s current price, expressed as a percentage. It’s important because it measures the income return on an investment and helps investors compare the cash income potential of different stocks.

How Do I Calculate Dividend Yield?

Use the formula:

For quarterly dividends, multiply the latest dividend by four to get the annual dividend.

What Is the Difference Between Trailing and Forward Dividend Yield?

Trailing dividend yield uses dividends paid over the past 12 months, while forward dividend yield estimates dividends for the upcoming year based on current company guidance or analyst forecasts.

Can a High Dividend Yield Be a Red Flag?

Yes. A very high dividend yield may indicate that the stock price has dropped due to underlying problems in the company, making it risky despite the attractive yield.

How Should Dividend Yield Influence My Investment Strategy?

Dividend yield is one of several metrics to consider. It’s best used alongside payout ratios, earnings growth, and cash flow analysis to select companies that not only offer attractive income but also have sustainable dividend policies.

Conclusion

Dividend yield is a simple yet powerful metric that provides a snapshot of the income potential of dividend-paying stocks. Whether you’re building a portfolio for regular income or looking to reinvest dividends for compounded growth, understanding dividend yield—and its context within a broader financial analysis—is crucial.

By calculating dividend yield, comparing it with industry norms, and assessing complementary metrics such as payout ratio and cash flow, investors can make well-informed decisions. While a high yield might catch your eye, always remember to delve deeper into the company’s financial health and growth prospects.

Armed with this knowledge, you’re better prepared to navigate the complexities of income investing. If you found this guide helpful, feel free to leave a comment or share your thoughts below. For further reading, explore our other in-depth articles on dividend investing and portfolio management.

Invest wisely, stay informed, and let your investments work for you.

Your post is well-written and offers practical advice for readers. Thanks for sharing your insights with us.

Amazing, we didn’t know that before. The author have provided new light on this topic. Thanks for bringing it up.