Table of Contents

Introduction to Register a Business in India

Registering a business in India is not only a legal requirement but also a strategic move that builds credibility, enhances investor confidence, and opens up avenues for tax benefits and financial incentives. With India’s rapidly growing economy, millions of entrepreneurs are seizing the opportunity to innovate and contribute to the nation’s development. Whether you are a budding startup owner or an established entrepreneur seeking expansion, understanding the registration process is critical. This guide provides a detailed, actionable roadmap designed to help you navigate the complexities of business registration in India, ensuring you meet both legal and financial compliance.

Also Read: What is a Business Model? A Beginner-Friendly Guide to Success

The Importance of Proper Business Registration

Registering your business in India lays the foundation for future growth and success. Here are some compelling reasons why proper registration is essential:

- Legal Compliance: Avoid fines and penalties by ensuring your business adheres to the regulations set forth by the Ministry of Corporate Affairs (MCA).

- Enhanced Credibility: A registered business gains trust among investors, banks, and customers, providing you with a competitive edge.

- Access to Finance: Registered businesses can easily access loans, venture capital, and other funding opportunities.

- Tax Benefits: Registration makes your business eligible for various tax deductions and government schemes.

- Intellectual Property Protection: Registering your business allows for trademark and copyright protection, safeguarding your brand identity.

These benefits not only streamline operations but also set the stage for sustainable growth in the competitive finance landscape.

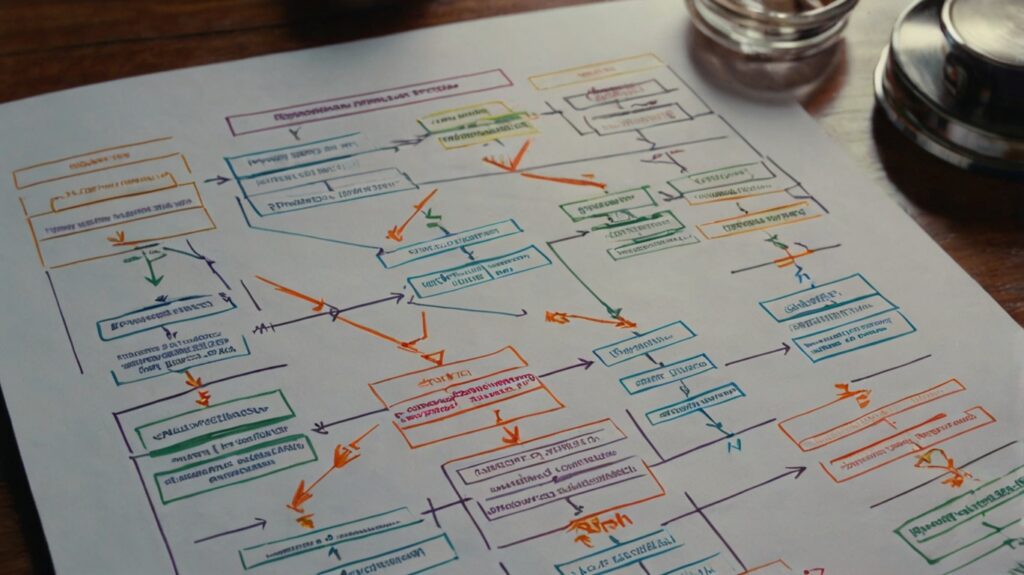

Understanding the Business Registration Process in India

Registering a business in India involves several key steps. Below, we outline the process in detail, supported by real-world examples and expert advice.

1. Define Your Business Structure

Choosing the right business structure is the first and most crucial decision. The structure will influence taxation, liability, and regulatory requirements. Common forms include:

- Sole Proprietorship: Ideal for small-scale operations, offering simplicity but limited liability protection.

- Partnership: Suitable for businesses with multiple owners; it provides shared responsibilities but has potential disputes.

- Limited Liability Partnership (LLP): Combines the benefits of a partnership with limited liability, ideal for professional services.

- Private Limited Company (Pvt. Ltd.): Preferred for startups and larger enterprises due to limited liability, easier access to funding, and higher credibility.

- Public Limited Company: Generally for large-scale operations with a broader investor base.

Expert Insight: “Choosing the correct structure is essential. While a sole proprietorship might be easier to set up, a Private Limited Company offers better opportunities for funding and growth,” says an industry expert in business finance.

2. Obtain a Digital Signature Certificate (DSC)

Since the registration process is largely digital, a Digital Signature Certificate is required to sign documents electronically. This certificate ensures that the filings are legally valid and secure.

- Actionable Steps:

- Identify a certified agency approved by the Controller of Certifying Authorities (CCA).

- Submit identity proofs and other required documents.

- Obtain the DSC for use during the online registration process.

3. Acquire a Director Identification Number (DIN)

A Director Identification Number is mandatory for anyone who intends to be a director of a company. The application process for DIN is straightforward and must be completed before the actual company registration.

- Requirements:

- Submit valid identity and address proofs.

- Provide digital photographs and a brief bio.

- Apply online via the MCA portal.

4. Name Approval Process

Choosing a unique and legally acceptable name is critical. The MCA portal facilitates the name reservation process.

- Steps Involved:

- Conduct a name search to ensure availability.

- File the RUN (Reserve Unique Name) application.

- Await confirmation and approval from MCA.

5. Preparation of Incorporation Documents

Once the name is approved, you need to prepare the required incorporation documents. These typically include:

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Proof of office address

- Details of directors and shareholders

Real-World Example: A startup in Bangalore successfully navigated this step by consulting a legal advisor who specialized in corporate law. This professional guidance ensured that all documents were in line with regulatory requirements, saving time and avoiding future legal hassles.

6. Filing the Incorporation Documents

After preparing all necessary documents, the next step is to file them online through the MCA portal.

- Filing Checklist:

- Upload signed and notarized documents.

- Fill out the requisite forms, including SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus).

- Pay the requisite fees online.

- Expert Tip: Double-check each document before submission to avoid rejection due to errors.

7. Post-Incorporation Compliance

After your business is registered, it is crucial to meet ongoing compliance requirements. This includes obtaining a Permanent Account Number (PAN), Tax Deduction and Collection Account Number (TAN), and adhering to annual filing requirements.

- Post-Incorporation Checklist:

- Apply for PAN and TAN through the NSDL portal.

- Open a business bank account.

- Register for Goods and Services Tax (GST) if applicable.

- Maintain proper accounting records and file annual returns with MCA.

Interactive Comparison: Types of Business Structures in India

Below is a comparative table that outlines key features of common business structures to help you decide which model best fits your business goals:

| Business Structure | Liability | Ease of Formation | Funding Opportunities | Regulatory Complexity |

|---|---|---|---|---|

| Sole Proprietorship | Unlimited | Very Easy | Limited | Low |

| Partnership | Joint & Several | Easy | Moderate | Moderate |

| LLP | Limited | Moderate | Moderate to High | Moderate |

| Private Limited Company | Limited | Moderate | High | High |

| Public Limited Company | Limited | Complex | Very High | Very High |

Note: The table above serves as a quick reference for entrepreneurs, helping them weigh the pros and cons of each business structure based on their unique requirements.

Financial Considerations and Expert Insights

Registering your business is a critical financial decision. The registration process requires an upfront investment, but the long-term benefits far outweigh the initial costs. Consider the following financial aspects:

Budgeting for Registration

- Registration Fees: These vary by business type and state. For example, Private Limited Companies often incur higher fees compared to LLPs.

- Professional Fees: Legal and consultancy fees may apply if you hire professionals to assist with document preparation.

- Compliance Costs: Regular compliance, such as annual filing fees, should be factored into your financial planning.

Financial Incentives

- Government Schemes: The Indian government offers various schemes and subsidies to promote startups and MSMEs. Familiarize yourself with initiatives like ‘Startup India’ which provides tax benefits and funding support.

- Tax Deductions: A registered business is eligible for numerous tax deductions, such as depreciation on assets, business expenses, and R&D incentives.

Expert Financial Advice

Financial advisors emphasize that proper planning during the registration phase can streamline future financial management. “Investing in professional guidance during the initial stages can prevent costly mistakes later,” notes a seasoned financial consultant. This advice is crucial for small business owners who might be juggling multiple roles and responsibilities.

Challenges and Tips for a Smooth Registration Process

Common Challenges

- Documentation Errors: Incomplete or inaccurate documents can lead to delays.

- Name Rejection: Choosing a name that does not meet MCA guidelines can require re-submission.

- Complex Compliance Requirements: Ongoing regulatory changes may require constant vigilance.

Pro Tips for a Smooth Process

- Hire a Professional: Consider hiring a company secretary or legal advisor with expertise in business registrations.

- Stay Updated: Regularly check the MCA website for updates on registration requirements and compliance norms.

- Use Digital Tools: Leverage online platforms and software that assist with document preparation and filing.

- Plan Your Finances: Create a detailed budget covering all aspects of the registration and compliance process.

- Engage in Networking: Join entrepreneur groups and forums for advice and shared experiences.

Bullet List Summary:

- Legal Compliance: Ensures adherence to regulatory standards.

- Enhanced Credibility: Builds trust with investors and customers.

- Financial Incentives: Access to government schemes and tax deductions.

- Professional Guidance: Reduces errors and smoothens the registration process.

Real-World Case Study: A Startup’s Journey to Registration

Consider the journey of a tech startup in Hyderabad. The founders, after identifying a market gap in financial technology, chose to register their venture as a Private Limited Company. They followed these steps:

- Business Structure: Opted for a Private Limited Company to facilitate future funding.

- DSC and DIN: Obtained the necessary digital credentials promptly.

- Name Approval: Faced initial challenges with name rejection but succeeded after brainstorming alternate names.

- Documentation: Consulted a legal advisor to ensure that their Memorandum and Articles of Association were compliant.

- Filing: Completed the SPICe+ process online, followed by prompt payment of fees.

- Post-Incorporation: Registered for GST and opened a dedicated business bank account.

The startup’s founders credited professional assistance and thorough financial planning for their smooth registration process. Their experience underscores the value of following a detailed, step-by-step approach to business registration in India.

Conclusion

Registering a business in India can be a transformative step for entrepreneurs. It not only legitimizes your venture but also opens doors to funding, tax benefits, and government incentives. By carefully choosing the right business structure, following the mandated steps for registration, and maintaining diligent post-incorporation compliance, you lay a robust foundation for future success. Remember, investing time in professional guidance and financial planning during this process can save significant challenges later on.

Key Takeaways:

- Proper Planning: Choose the right business structure based on your long-term goals.

- Compliance: Meet all legal requirements from DSC and DIN to post-incorporation filings.

- Financial Strategy: Budget for registration fees, professional costs, and future compliance.

- Expert Advice: Consult with legal and financial experts to streamline the process.

Embrace the registration process as a strategic business move. With thorough preparation and expert insights, you can set your business on a path to sustainable growth and financial success.

FAQs

What is the most common business structure chosen by startups in India?

Most startups opt for a Private Limited Company due to its limited liability benefits and easier access to funding, despite the relatively higher compliance requirements.

How long does it typically take to register a business in India?

The registration process can vary but generally takes between 15 to 30 days from the submission of complete and accurate documents on the MCA portal.

Are there any government schemes available to assist with business registration costs?

Yes, schemes like Startup India provide tax benefits, subsidies, and funding opportunities to assist startups during the early stages of business registration and growth.

Can I register my business online, or is physical documentation required?

Most of the registration process in India is carried out online via the MCA portal, including document uploads, form submissions, and fee payments. However, certain verification processes may require physical document submission.

What post-incorporation compliances should I be aware of after registering my business?

After registration, you must apply for PAN and TAN, register for GST if applicable, open a business bank account, and adhere to annual filing requirements with the MCA, along with maintaining accurate accounting records.

By following the steps outlined in this guide, you can navigate the complexities of business registration in India with confidence. Whether you are at the planning stage or already in the process, these insights and tips will help ensure your venture not only complies with legal requirements but is also positioned for long-term financial success. Embrace this journey with a clear strategy, and watch your entrepreneurial vision transform into a thriving business.

Delete it,please! [url=https://watches-eshop.com/].[/url]

[…] Also Read: Step-by-Step Guide: How to Register a Business in India for Success […]

Page Not Found | Financelti

[url=https://applebe.ru]Programs as SaaS[/url]

[url=http://rashijyotish.online/british-designer-create-arras/]Hello[/url] [url=http://project1point5.com/2023/06/15/iqbr-1-3/]Hello[/url] [url=http://vivienneironwood.com/2023/04/30/april-statistics/]Hello[/url] [url=http://nycityremodeling.com/how-to-plan-a-successful-home-addition/]Hello[/url] [url=http://dorytuasistente.com/2021/12/05/hablemos-de-mini-habitos/]Hello[/url] 75f8fe6 [url=https://images.google.com.fj/url?sa=t&url=https://s2bs.ru]SaaS[/url]

BwSMk00UoUk4kWoqQpUAzmist

Page Not Found | Financelti

[url=https://applebe.ru]Programs as SaaS[/url]

[url=http://solarxess.com/blog/everything-you-have-to-know-in-regards-to-the/]Hello[/url] [url=http://vulcan-clan.com/index.php/guestbook/index/index]Hello[/url] [url=http://kuobao.com.vn/may-bom-cong-nghiep/]Hello[/url] [url=http://trajectorytowealth.com/reviews/namecheap-review/]Hello[/url] [url=http://grandmesaluxurycollection.com/2022/09/13/hello-world/]Hello[/url] 3c7fee7 [url=http://robertinocourymusic.com/__media__/js/netsoltrademark.php?d=https://s2bs.ru]SaaS[/url]

Spectrum of gases – cargo Ulyanovsk

[img]https://gas73.ru/assets/img/O2_C3H8.png[/img]

[url=https://dzen.ru/id/601fc4eb0c34da5eddcddc03]Hidrogen C2H2[/url]

Phones: +7(9272)70-80-09

Fax: +7 (8422) 65-10-78.

2025

https://pivovarenie.com.ua/

Crypto market trends Are you ready to stay ahead in the ever-evolving world of cryptocurrency? Our exclusive analytics tool provides you with real-time insights and forecasts that can transform the way you invest. Don’t miss out on the opportunity to understand market movements and make informed decisions. Experience the power of data-driven strategies with our platform today!

[url=https://cryptolake.online/btc]https://cryptolake.online/btc[/url]

ykovaleva052@gmail.com

[url=]Programs as SaaS[/url]

Your commitment and zeal shine through in every word you write, motivating readers to embrace their own passions.

Your blog has swiftly become my preferred source of inspiration. Thank you for sharing your distinctive perspective with the world.

Здравствуйте!

Медицина занимается лечением боли и улучшением качества жизни. Специалисты по боли — отдельное направление в медицине. Обезболивание стало одной из важнейших задач медицины. Статьи по медицине рассказывают об эффективных методах. Медицина приносит облегчение страдающим.

Подробнее на – https://gbmse87.ru/

Финансы и инвестиции требуют анализа и грамотного подхода. Управление финансами помогает эффективно распределять капитал. Правильные финансы обеспечивают максимальную доходность и минимальные риски. Финансы помогают достигать финансовой независимости. Знания о финансах важны для инвесторов.

Подробнее на – https://checkbm.ru/

Удачи!

Здравствуйте!

Медицина помогает адаптироваться к последствиям хронических болезней. Множество людей зависит от поддержки медицины ежедневно. Паллиативная медицина облегчает страдания пациентов. Статьи по медицине объясняют, как справляться с трудными диагнозами. Медицина всегда рядом в тяжёлые периоды.

Больше информации на сайте – https://my-hepatit.ru/

Интерьер с использованием живых растений оживляет помещение и улучшает микроклимат. Растения придают комнате свежесть и естественность. Интерьер с живыми растениями подходит для любых комнат и стилей. Такой дизайн способствует расслаблению и позитивному настроению. Интерьер становится живым и комфортным.

Подробнее на – https://сувенир116.рф/

Удачи!