Table of Contents

In today’s complex healthcare landscape, finding ways to manage medical expenses effectively is crucial. Enter the Health Savings Account (HSA) – a powerful financial tool that’s gaining popularity among savvy savers and healthcare consumers. But what exactly is an HSA, and how can it benefit you? Let’s dive into the world of Health Savings Accounts and uncover why they’re becoming an essential part of many Americans’ financial strategies, particularly as healthcare costs continue to rise and the need for efficient savings vehicles becomes increasingly important.

Also Read: How to Open a Joint Bank Account: A Simple Guide for Couples & Partners

How a Health Savings Account Works: Key Features and Benefits

A health savings account offers a unique triple tax advantage for managing healthcare costs. At its core, an HSA is a tax-advantaged savings account designed specifically for healthcare expenses. It works hand-in-hand with a High Deductible Health Plan (HDHP) to provide a comprehensive approach to healthcare financing. This powerful combination allows individuals and families to take greater control of their healthcare spending while building a substantial safety net for future medical needs.

Key features of HSAs include:

- Tax-deductible contributions that reduce your taxable income for the year

- Tax-free growth on investments within the account, including interest, dividends, and capital gains

- Tax-free withdrawals for qualified medical expenses, ranging from doctor visits to prescription medications

This triple tax benefit sets HSAs apart from other savings vehicles, making them an attractive option for both short-term healthcare needs and long-term financial planning. Unlike Flexible Spending Accounts (FSAs), HSAs have no “use it or lose it” provision, allowing your balance to grow year after year, potentially accumulating significant savings over time.

2025 HSA Contribution Limits: Maximizing Your Health Savings

The HSA contribution limits for 2025 have increased, allowing for greater savings potential. These adjustments reflect the impact of inflation and the growing importance of healthcare savings in personal financial planning. Here’s a breakdown of the new limits:

| Coverage Type | 2025 Contribution Limit | Increase from 2024 |

|---|---|---|

| Self-Only | $4,300 | +$150 |

| Family | $8,550 | +$250 |

| Age 55+ Catch-up | $1,000 (no change) | $0 |

These increased limits reflect the government’s recognition of rising healthcare costs and the importance of saving for medical expenses. The additional catch-up contribution for those 55 and older provides an extra opportunity to boost healthcare savings as retirement approaches, ensuring better preparation for future medical needs.

High Deductible Health Plans: The Foundation of HSA Eligibility

To qualify for an HSA, you must be enrolled in a high deductible health plan that meets specific IRS criteria. For 2025, these criteria are:

- Minimum deductible: $1,650 for self-only coverage, $3,300 for family coverage

- Maximum out-of-pocket: $8,300 for self-only coverage, $16,600 for family coverage

HDHPs typically have lower monthly premiums but higher deductibles, making them a good fit for those who are generally healthy and want to save on monthly healthcare costs. This structure encourages more conscious healthcare spending while providing protection against catastrophic medical expenses. The combination of lower premiums and tax-advantaged savings through an HSA can create significant financial benefits for many individuals and families.

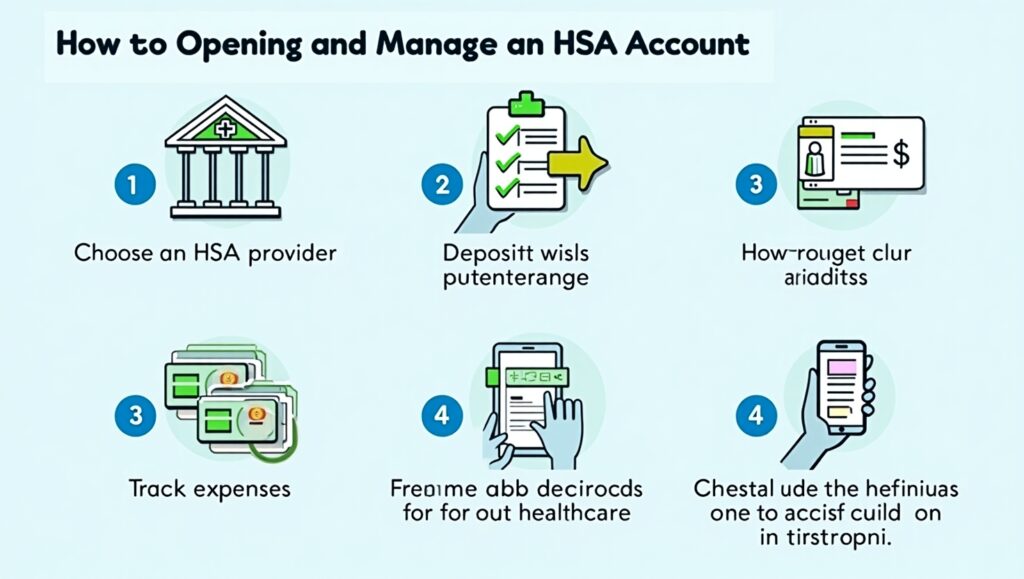

Opening and Managing Your HSA Account: A Step-by-Step Guide

Opening an HSA account is a strategic move for both current and future healthcare expenses. Here’s how to get started:. The process requires careful consideration of various factors, including your current health status, financial goals, and healthcare spending patterns. When evaluating HSA options, it’s important to consider factors such as account fees, investment options, and account accessibility. Many financial institutions and healthcare providers offer HSA programs, each with its own unique features and benefits that can align with different individual needs and preferences.

- Confirm your eligibility: Ensure you’re enrolled in a qualifying HDHP and meet other IRS requirements. This involves verifying that your health plan meets the minimum deductible and maximum out-of-pocket thresholds set by the IRS. Additionally, confirm that you’re not enrolled in Medicare, claimed as a dependent on someone else’s tax return, or covered by another non-HDHP health insurance plan, as these factors could disqualify you from HSA participation.

- Choose an HSA provider: Many banks and financial institutions offer HSAs. Compare fees, investment options, and user interfaces. Look for providers that offer competitive interest rates on savings, diverse investment portfolios, and user-friendly digital platforms for account management. Consider factors such as monthly maintenance fees, transaction costs, minimum balance requirements, and the availability of additional services like online bill pay or mobile check deposit. Some providers may also offer educational resources and tools to help you maximize your HSA benefits.

- Complete the application: Provide necessary personal and financial information. This typically includes your name, address, social security number, employment details, and information about your HDHP. You may need to designate beneficiaries for your account and set up online access credentials. Some providers might require additional documentation to verify your identity or HDHP enrollment status. Be prepared to review and sign account agreements that outline terms, conditions, and fee structures.

- Set up contributions: Decide on your contribution amount and frequency. You can contribute via payroll deductions or personal contributions. Payroll deductions offer the advantage of immediate tax savings, while personal contributions can be deducted when filing your tax return. Consider setting up automatic monthly contributions to ensure consistent savings throughout the year. Remember to factor in any employer contributions when planning your annual contribution strategy to avoid exceeding IRS limits.

- Start using your HSA: Use your HSA debit card or reimburse yourself for qualified medical expenses. Most providers issue a dedicated HSA debit card that can be used at healthcare providers, pharmacies, and other medical facilities. Keep detailed records of all healthcare expenses, including receipts and documentation of the medical necessity of purchases. Many HSA providers offer online portals or mobile apps to help track expenses, store digital receipts, and manage reimbursements efficiently.

Remember, HSA funds roll over year to year, so there’s no pressure to “use it or lose it” as with some other healthcare accounts. This feature allows you to build a substantial healthcare nest egg over time, potentially accumulating significant savings for future medical needs or retirement healthcare expenses.

Maximizing Your HSA: Investment Strategies and Long-Term Planning

Understanding how a health savings account works is crucial for maximizing its benefits and tax advantages. While many use their HSA for current medical expenses, savvy account holders also leverage HSAs as long-term investment vehicles. Here are some detailed strategies to consider:

- Maximize contributions: Try to contribute the full annual limit if possible. This means carefully budgeting your healthcare savings throughout the year and taking advantage of any employer contributions. Consider increasing your contributions during high-income months or when receiving bonuses to reach the annual limit. If you’re age 55 or older, don’t forget to make catch-up contributions to boost your savings further.

- Invest for growth: Many HSAs offer investment options. Consider investing a portion of your balance for long-term growth. Look for low-cost index funds, mutual funds, or ETFs that align with your risk tolerance and investment timeline. Some providers recommend maintaining a cash buffer for immediate medical expenses while investing the remainder for potential long-term appreciation. Regular portfolio rebalancing and monitoring of investment performance can help optimize your returns.

- Pay medical expenses out-of-pocket: If you can afford it, pay smaller medical expenses out-of-pocket and let your HSA balance grow tax-free. This strategy allows your HSA investments to compound over time, potentially generating significant returns. By preserving your HSA balance, you’re essentially creating a dedicated healthcare fund for future major medical expenses or retirement healthcare costs.

- Save receipts: Keep records of all qualified medical expenses. You can reimburse yourself tax-free at any time in the future. Maintain a digital or physical filing system for healthcare receipts, explanation of benefits statements, and other relevant documentation. This allows you to build a tax-free withdrawal option for future needs while letting your HSA balance grow through investments.

By treating your HSA as a long-term savings account, you can potentially accumulate a significant nest egg for future healthcare needs or retirement. This approach takes advantage of the unique triple tax benefit while creating a dedicated source of funds for healthcare expenses later in life.

HSA vs FSA: Understanding the Key Differences

When exploring healthcare savings options, it’s important to understand the difference between FSA and HSA accounts. Here’s a comprehensive comparison:

- Ownership: HSAs are owned by the individual; FSAs are owned by the employer. This means HSA funds remain yours regardless of employment changes, providing greater flexibility and control over your healthcare savings.

- Portability: HSA funds stay with you if you change jobs; FSA funds typically don’t. This makes HSAs a more reliable long-term savings vehicle for healthcare expenses.

- Contribution limits: HSAs have higher contribution limits and allow catch-up contributions for those 55 and older. This provides greater potential for building substantial healthcare savings over time.

- Rollover: HSA funds roll over year to year; FSAs typically have limited rollover options. This feature eliminates the pressure to spend down account balances at year-end.

- Investment potential: HSAs often offer investment options; FSAs do not. This allows HSA holders to potentially grow their healthcare savings through market investments.

While both accounts offer tax advantages for healthcare spending, HSAs provide more flexibility and long-term savings potential.

Pros and Cons of Health Savings Accounts

Like any financial tool, HSAs have their advantages and disadvantages. Let’s break them down:

Pros:

- Triple tax advantage

- Potential for long-term savings and investment growth

- Flexibility in using funds for current or future medical expenses

- Can be used as an additional retirement savings vehicle

- No “use it or lose it” rule

Cons:

- Mandatory enrollment in High Deductible Health Plans (HDHPs) can present significant challenges for certain individuals. These plans require substantial out-of-pocket expenses before insurance coverage kicks in, which may strain budgets for those with regular medical needs or limited financial resources. The high deductibles could be particularly burdensome for families with young children or individuals managing chronic conditions who require frequent medical attention.

- The implementation of penalties for non-qualified withdrawals before age 65 serves as a significant deterrent. These penalties include not only paying income tax on the withdrawn amount but also an additional 20% penalty fee. This strict regulation can limit financial flexibility during emergencies when funds might be needed for non-medical purposes. The penalty structure essentially locks away funds until retirement age unless used specifically for qualified medical expenses.

- The requirement for meticulous record-keeping of medical expenses demands considerable time and organizational skills. Account holders must maintain detailed documentation of all healthcare-related transactions, including receipts, medical bills, and explanation of benefits statements. This administrative burden can become overwhelming, especially when tracking multiple family members’ expenses over several years. Additionally, in case of an IRS audit, having proper documentation is crucial to justify HSA withdrawals.

- The cost-saving nature of HSAs might inadvertently encourage some individuals to postpone necessary medical care to preserve their account balance. This delayed care approach could lead to more serious health issues and potentially higher medical costs in the long run. Some account holders might skip preventive care or routine check-ups, which could compromise their overall health and wellness.

FAQs

Can I use my HSA for non-medical expenses?

While Health Savings Accounts are primarily designed for medical expenses, they do offer flexibility for non-medical withdrawals. However, such withdrawals come with significant financial implications. If you’re under 65, you’ll face both income tax obligations and a substantial 20% penalty on the withdrawn amount. This penalty structure is designed to discourage non-medical use of HSA funds. Once you reach age 65, the rules become more lenient – you can use the funds for any purpose without incurring the 20% penalty, though you’ll still need to pay regular income tax on non-medical withdrawals. This flexibility makes HSAs an attractive retirement savings vehicle, complementing traditional retirement accounts.

What happens to my HSA if I leave my job?

One of the most advantageous features of HSAs is their complete portability. Your HSA remains your property regardless of employment changes, mergers, or company closures. You maintain full control over the account and can continue using the accumulated funds for qualified medical expenses indefinitely. However, to make new contributions, you must maintain enrollment in a qualifying High Deductible Health Plan. This portability feature provides valuable financial security during career transitions and ensures continuous access to healthcare funds.

Can I contribute to an HSA if I’m on Medicare?

Medicare enrollment directly impacts HSA contribution eligibility. Once you enroll in any part of Medicare (including Part A), IRS regulations prohibit new contributions to your HSA. This restriction applies even if you maintain coverage under a qualifying HDHP. However, you retain full access to any existing HSA funds, which can be used tax-free for qualified medical expenses, including many Medicare premiums and out-of-pocket costs. Understanding this limitation is crucial for retirement planning and healthcare expense management.

Are dental and vision expenses eligible for HSA funds?

HSAs offer broad coverage for dental and vision care expenses, extending beyond just basic medical needs. Qualified expenses include routine dental check-ups, cleanings, fillings, crowns, orthodontics, and major dental work. Vision care coverage encompasses eye examinations, prescription eyeglasses, contact lenses, vision correction surgery, and related supplies. This comprehensive coverage makes HSAs particularly valuable for managing the often-significant costs of dental and vision care, which might not be fully covered by traditional health insurance plans.

Conclusion: Is an HSA Right for You?

Health Savings Accounts represent a sophisticated financial tool that combines immediate tax advantages with long-term savings potential. They particularly appeal to individuals who maintain good health, possess adequate financial resources for healthcare saving, and seek effective tax reduction strategies. The triple tax advantage – tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses – creates a powerful vehicle for healthcare financing.

However, the decision to establish an HSA requires careful evaluation of your personal circumstances, including your health status, financial capacity, and future objectives. Professional guidance from financial advisors or healthcare experts can provide valuable insights into whether an HSA aligns with your specific situation and long-term financial strategy.

In an era of escalating healthcare costs, HSAs emerge as increasingly valuable instruments for expense management and future planning. By developing a thorough understanding of HSA mechanics and strategically utilizing their benefits, you can enhance your approach to healthcare financing while potentially strengthening your overall financial well-being. The long-term advantages of HSAs, particularly in retirement planning, make them worthy of serious consideration in your comprehensive financial strategy.

Your post is fascinating. We learnt a lot from it. Thanks for posting your knowledge and experiences.

Your commitment and enthusiasm shine through in every section. It’s truly inspiring.