In the rapidly evolving landscape of personal finance and wealth management, Unit Linked Insurance Plans (ULIPs) have emerged as a unique hybrid product that combines the dual benefits of life insurance protection and market-linked investment opportunities. This comprehensive guide delves into the intricacies of ULIPs, offering actionable financial advice, real-world examples, and expert insights designed to help you make informed decisions.

Also Read: What is Compound Interest? Unleashing the Power of “Interest on Interest”

Table of Contents

Introduction

In today’s dynamic financial environment, individuals seek products that not only safeguard their future but also offer growth potential. ULIPs stand out in this regard by integrating insurance with investment. With rising awareness of diversified financial planning, ULIPs have garnered significant attention from both seasoned investors and those new to the world of finance.

By the end of this guide, you will have a deep understanding of ULIPs and be better equipped to determine if they align with your financial goals.

What Are ULIPs?

Definition and Basic Concept

ULIPs, or Unit Linked Insurance Plans, are financial products offered by insurance companies that provide both investment and insurance coverage. A portion of your premium is allocated to life insurance, while the remaining amount is invested in a range of market-linked securities, such as equities, debt instruments, or balanced funds. This dual structure means that ULIPs offer the security of life cover along with the potential for wealth creation through investments.

Evolution in the Finance Industry

Initially introduced as a way to encourage long-term savings with an added layer of protection, ULIPs have evolved to include features such as fund switching and flexible investment strategies. As the financial markets have matured, so too have ULIPs, with many products now offering options tailored to varying risk appetites and financial objectives.

How Do ULIPs Work?

ULIPs operate on a simple yet sophisticated mechanism that blends the benefits of insurance with those of investment:

Premium Allocation

When you invest in a ULIP, your premium is split into two components:

- Insurance Component: This part provides life cover to your beneficiaries.

- Investment Component: The remaining amount is channeled into various funds that can be actively managed by professional fund managers.

Investment Process

- Fund Selection: Policyholders can choose from a variety of funds—ranging from equity to debt—based on their risk tolerance and financial goals.

- Unit Creation and NAV: The invested funds are converted into units. Each unit carries a Net Asset Value (NAV) that reflects the market performance of the underlying assets. The NAV is updated regularly, providing transparency on the value of your investment.

- Fund Switching: One of the notable features of ULIPs is the flexibility to switch between different funds. This allows investors to realign their portfolios in response to market trends without the need for additional paperwork.

Key Processes Illustrated

Below is a simplified flowchart of how ULIPs work:

- Step 1: Pay Premium

⮕ Step 2: Premium Split (Insurance + Investment)

⮕ Step 3: Investment Allocation (Units Created)

⮕ Step 4: NAV Calculation

⮕ Step 5: Regular Updates & Fund Switching Options

Real-World Example

Consider the case of Mr. Sharma, a 35-year-old professional with a moderate risk appetite. He opts for a ULIP that offers a balanced fund option. Each month, he pays a premium that is split into:

- A component for life cover.

- A component that gets invested in a mix of equity and debt funds.

Over time, thanks to regular fund switching aligned with market conditions, Mr. Sharma’s investment grows, providing him both protection and the potential for long-term wealth accumulation. His experience underscores how ULIPs can be tailored to meet specific financial needs while adapting to market fluctuations.

Key Features and Benefits of ULIPs

ULIPs offer several advantages that appeal to a diverse range of investors. Here are the primary benefits:

Dual Benefit: Insurance and Investment

- Life Cover: Ensures financial security for your loved ones in the event of unforeseen circumstances.

- Wealth Creation: Offers the potential for capital appreciation through investments in various market segments.

Flexibility and Customization

- Fund Switching: Allows policyholders to shift between funds based on changing market conditions or personal risk tolerance.

- Investment Options: A range of funds—from aggressive equity to conservative debt—cater to different financial goals.

Professional Fund Management

- Expert Oversight: Investment decisions are made by seasoned professionals who continuously monitor market trends.

- Reduced Effort: Investors do not need to actively manage their portfolio, as the onus of decision-making rests with professional fund managers.

Partial Withdrawals and Liquidity

- Liquidity Feature: After a stipulated lock-in period (usually five years), policyholders can make partial withdrawals, offering financial flexibility without terminating the policy.

- Emergency Needs: The ability to access funds provides a safety net in times of urgent financial requirements.

Tax Benefits

- Tax Efficiency: Many ULIPs come with tax benefits on both the premium paid and the maturity proceeds under prevailing tax laws, which can be an added incentive for investors.

Comparison Table

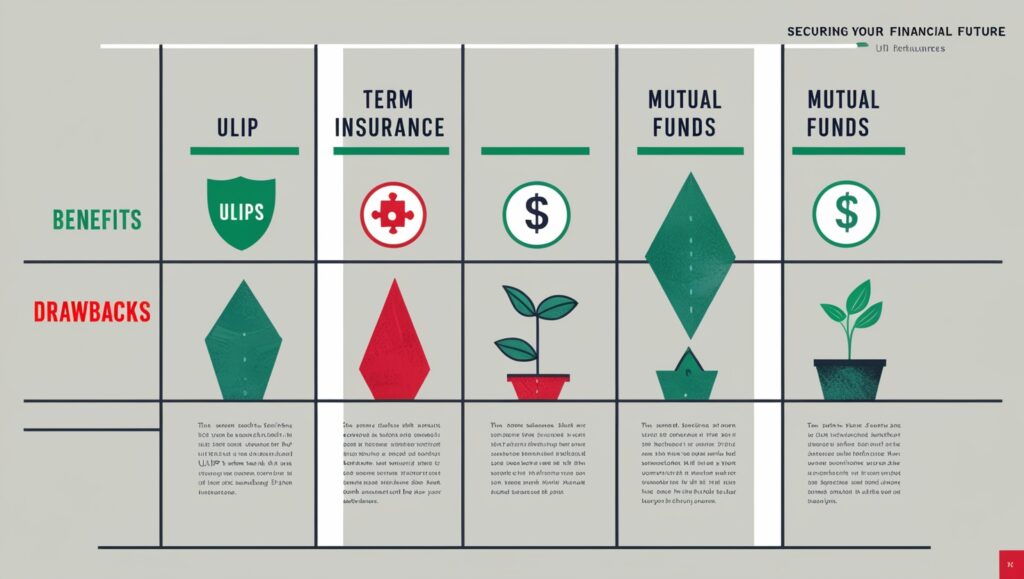

The table below compares ULIPs with traditional life insurance and mutual funds, highlighting their distinct features:

| Feature | ULIP | Traditional Life Insurance | Mutual Funds |

|---|---|---|---|

| Dual Benefit | Yes (Investment + Insurance) | No (Only Insurance) | No (Only Investment) |

| Investment Flexibility | High (Fund Switching available) | None | High (Varied schemes available) |

| Liquidity | Partial withdrawals post lock-in | Surrender value available, but less flexible | High liquidity |

| Professional Management | Yes (Fund managers) | N/A | Yes (Fund managers) |

| Tax Benefits | Under specific conditions | Under specific conditions | Under specific conditions |

Charges Associated with ULIPs

While ULIPs offer several advantages, it is important to understand the various charges that can affect overall returns. These charges vary among providers and plans, but typically include:

Types of Charges

- Premium Allocation Charges:

A portion of the premium is deducted before it is allocated to the investment and insurance components. - Policy Administration Charges:

Fees that cover the administrative costs associated with managing the policy. - Fund Management Charges:

These fees are deducted for professional management of the investment funds. - Mortality Charges:

Cost of providing the life insurance cover, which varies based on the age, health, and sum assured. - Surrender/Withdrawal Charges:

Applicable if you decide to withdraw funds or surrender the policy before the maturity date.

Impact on Returns

It is crucial to weigh these charges against the potential benefits. While ULIPs offer tax advantages and investment growth, high charges can erode returns, especially if the policy is held for a short duration. Thus, a careful comparison of ULIP products is necessary before committing to a plan.

Comparing ULIPs with Other Financial Products

ULIPs vs. Term Insurance

- Term Insurance:

Purely provides life cover with no investment component. Premiums are generally lower compared to ULIPs. - ULIPs:

Combine life cover with investment, thereby serving dual purposes. However, the premium is higher due to the added investment feature.

ULIPs vs. Mutual Funds

- Mutual Funds:

Primarily an investment product with no insurance benefits. Investors have complete liquidity and a broader range of fund options. - ULIPs:

Offer the added benefit of insurance along with investments. However, liquidity is somewhat restricted due to lock-in periods and charges.

When to Choose a ULIP

- Long-Term Financial Goals:

Ideal for individuals looking to achieve long-term wealth creation while ensuring financial protection. - Tax Efficiency:

Suitable for those seeking products that offer both tax benefits and dual financial advantages. - Discipline and Diversification:

ULIPs encourage a disciplined savings approach and offer a diversified investment portfolio through different fund options.

Expert Insights and Case Studies

Financial Advisor Perspectives

Many financial advisors suggest that ULIPs can be an effective tool for holistic financial planning. Experts emphasize the following points:

- Long-Term View: ULIPs are best suited for individuals with a long-term investment horizon, typically over 10–15 years.

- Customized Approach: The flexibility to switch funds allows policyholders to adapt to market conditions, making ULIPs a dynamic investment tool.

- Risk Mitigation: While ULIPs do carry market risk, the insurance component provides a cushion against unforeseen financial challenges.

Case Study: Balancing Risk and Reward

Consider the example of a mid-career professional aiming to balance investment growth with financial security. By opting for a ULIP with a balanced fund, the policyholder benefits from:

- Equity Exposure: Capturing growth potential during bullish market phases.

- Debt Exposure: Providing stability during market downturns.

- Professional Management: Ensuring the portfolio is actively managed to align with market dynamics.

This case illustrates how ULIPs can serve as a multifaceted tool, particularly for those who wish to streamline their financial goals into one integrated product.

Practical Financial Advice for ULIP Investors

When considering ULIPs as a part of your financial strategy, keep the following tips in mind:

- Understand Your Financial Goals:

Clearly define whether your priority is long-term wealth creation, tax efficiency, or comprehensive financial protection. - Assess Your Risk Appetite:

Choose fund options within the ULIP that align with your risk tolerance. If you are conservative, opt for debt or balanced funds; if you are aggressive, consider equity options. - Compare Charges:

Evaluate the fee structure of different ULIPs. Even small differences in charges can significantly impact long-term returns. - Review Fund Performance:

Look at historical performance data and research the credibility of the fund managers. Past performance is not always indicative of future returns, but it can provide valuable insights. - Consult Financial Experts:

Seek advice from independent financial advisors to ensure that the ULIP you select fits within your broader financial strategy.

Conclusion

Unit Linked Insurance Plans are a powerful financial tool that blend the protection of life insurance with the potential for market-driven growth. Their flexibility, coupled with the ability to switch funds and tailor investments to personal risk profiles, makes them an attractive option for a wide array of investors. However, as with all financial products, understanding the associated charges and aligning them with your long-term financial goals is paramount.

ULIPs are particularly beneficial for those looking to build wealth over a long horizon while also securing their family’s future. By considering your risk appetite, comparing various ULIP offerings, and consulting with financial experts, you can harness the full potential of these innovative products. Remember, financial planning is a continuous process—regular reviews and adjustments are key to adapting to market dynamics and achieving sustained financial success.

FAQs

What is a ULIP, and how does it differ from traditional life insurance?

ULIPs combine life insurance with investment opportunities. Unlike traditional life insurance, which only provides a death benefit, ULIPs allocate a portion of your premium to investments, potentially leading to wealth creation over time.

How are premiums utilized in a ULIP?

Premiums in a ULIP are split into two parts: one for the life insurance coverage and the other for investments in various funds. This allocation allows policyholders to enjoy both protection and investment growth.

What are the key charges associated with ULIPs?

Common charges include premium allocation charges, policy administration fees, fund management charges, mortality charges, and surrender or withdrawal fees. It is essential to review these charges as they can impact the overall returns.

When should I consider investing in a ULIP?

ULIPs are ideal for individuals with long-term financial goals who seek a combination of insurance and investment benefits. They are especially suitable for those looking for tax-efficient products and diversified investment options.

Can I switch funds within my ULIP?

Yes, one of the key benefits of ULIPs is the flexibility to switch between different funds based on your risk tolerance and changing market conditions. This feature allows you to adjust your investment strategy without the need for extensive paperwork.

By understanding the mechanics, benefits, and potential pitfalls of ULIPs, you are better positioned to make informed decisions in your financial journey. With careful planning, ongoing assessment, and professional guidance, ULIPs can be a valuable addition to your long-term wealth management strategy.

[…] Also Read: The Power of ULIPs: A Comprehensive Guide to Unit Linked Insurance Plans […]

Your article is superb. We liked reading it. Thank you for writing such a well-written post.

This post is a thorough guide on the subject; it’s a goldmine of insights.