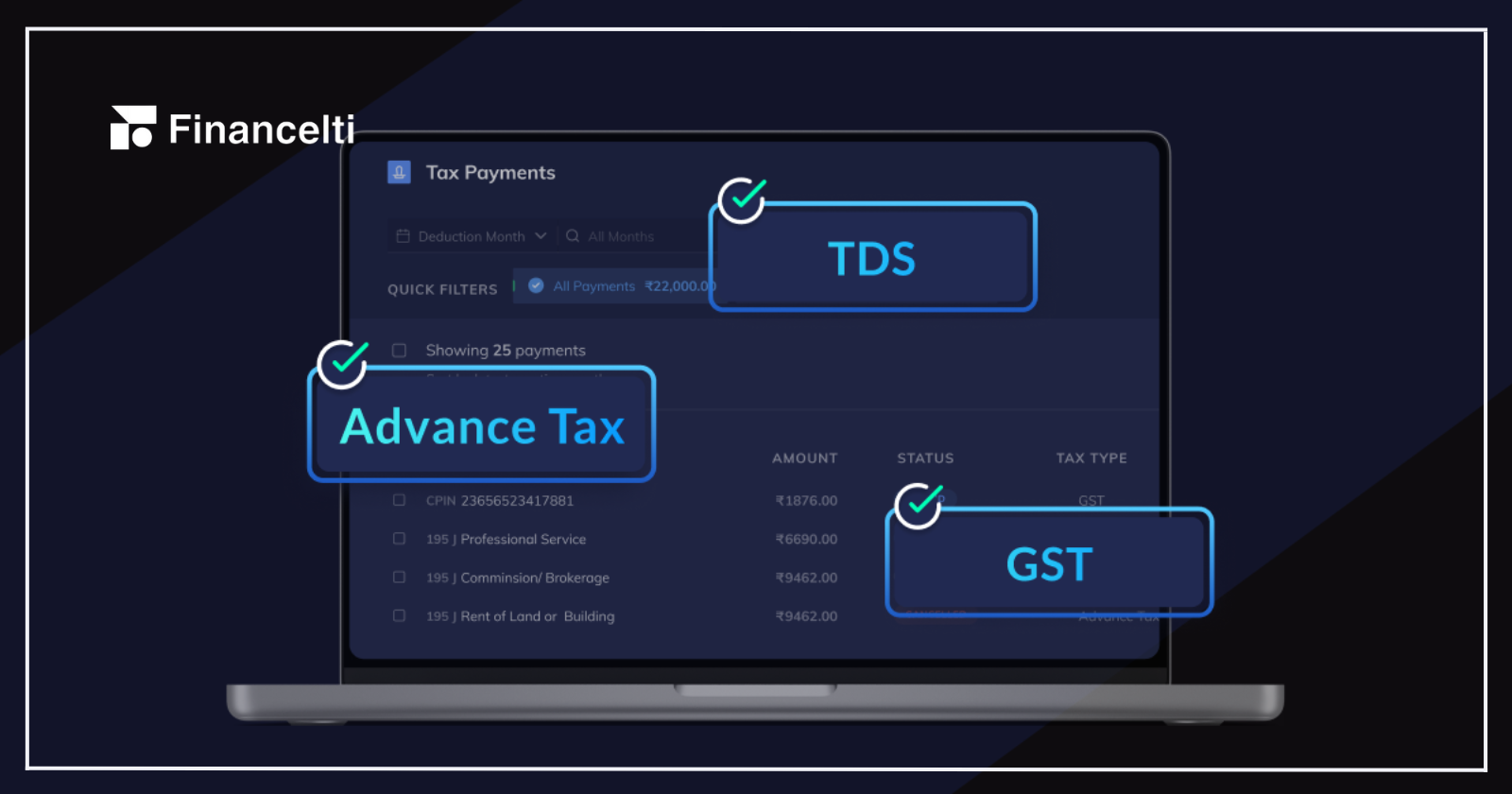

Tax accounting plays a crucial role in the financial management of individuals, businesses, corporations, and other entities. It involves the preparation of tax returns and the calculation of tax payments. In this comprehensive guide, we will explore the definition of tax accounting, its different types, and how it compares to financial accounting. We will also delve into the intricacies of tax accountant for individuals and businesses, and answer some frequently asked questions. So let’s dive in!

Table of Contents

Definition of Tax Accounting

Tax accounting can be defined as the specialized branch of accounting that focuses on the preparation of tax returns and the calculation of tax payments. It is governed by the Internal Revenue Code, which outlines the specific rules and regulations that individuals and businesses must follow when preparing their tax documents. Tax accountant is essential for everyone, including individuals, businesses, corporations, and other entities, as it allows for the accurate tracking of funds associated with taxes.

Types of Tax Accounting

Tax accounting is a crucial aspect of financial management that deals with the preparation, analysis, and submission of tax returns. It involves a variety of techniques and strategies that help individuals and businesses comply with tax laws and regulations while minimizing their tax liabilities. There are several types of tax accounting, each with its own unique purpose and application.

One of the most common types of tax accountant is income tax accounting, which focuses on calculating and reporting the taxable income of an individual or business. This involves gathering and analyzing financial data such as revenue, expenses, and deductions to determine the amount of taxable income and the corresponding tax liability.Another type of tax accounting is sales tax accounting, which involves tracking and reporting the sales tax obligations of a business. This includes collecting and remitting sales tax to the appropriate authorities, as well as calculating and reporting the sales tax liability on tax returns.

In addition, there is also property tax accountant, which deals with the assessment and payment of property taxes. This involves determining the value of real estate and other property, calculating the corresponding tax liability, and ensuring timely payment of property taxes.Overall, tax accounting plays a critical role in helping individuals and businesses manage their tax obligations effectively and efficiently. By understanding the different types of tax accounting and their respective applications, taxpayers can make informed decisions and ensure compliance with tax laws and regulations. Read More.

Individual Tax Accounting

Individual tax accounting is a crucial aspect of managing one’s finances. It is the process of tracking and managing an individual’s tax obligations and responsibilities. This includes recording and analyzing income, identifying qualifying deductions, tracking charitable donations, and monitoring investment gains or losses.

The goal of individual tax accounting is to ensure that an individual’s tax calculations are accurate and their tax reporting is done in compliance with relevant tax laws and regulations. While some individuals may choose to manage their own tax accountant, seeking the assistance of professional tax accountants may be beneficial.

Tax accountants can provide expert guidance on complex tax issues, help maximize tax deductions, and ensure that all tax obligations are efficiently and accurately fulfilled. Overall, individual tax accounting is a critical component of financial management that can help individuals stay on top of their tax obligations and avoid potential penalties or legal issues.

Business Tax Accounting

When it comes to tax accountant, there is a key difference between individual and business taxes. Business tax accountant is much more complex and involves a deeper analysis of a company’s financial situation. Business tax accountants are responsible for analyzing a company’s earnings, expenses, and investments to determine its tax liability.

This involves a thorough understanding of tax laws and regulations to ensure compliance. In addition to ensuring compliance, business tax accountants also identify tax-saving opportunities for their clients. This requires a close examination of a company’s financial practices and identifying areas where they can reduce their tax liability. By optimizing a company’s tax strategy, business tax accountants can help their clients save money and improve their bottom line.

Overall, business tax accounting is a critical component of any successful business. It requires a high level of expertise and attention to detail to ensure compliance with tax laws and regulations while also finding ways to minimize tax liability. Working with a skilled business tax accountant can help businesses achieve their financial goals and set them up for long-term success.

Tax Accounting for Tax-Exempt Organizations

Tax-exempt organizations, despite being exempted from paying taxes, are still required to engage in tax accounting. Such organizations must file annual returns, which are used to provide detailed information about their incoming funds, such as grants or donations, and how those funds are utilized.

In addition, tax accountant ensures that tax-exempt entities comply with all relevant laws and regulations, including those governing the use of funds. This helps to promote transparency and accountability in the financial activities of these organizations, thereby fostering public trust and confidence in them.

Tax Accounting vs. Financial Accounting

Tax accountant and financial accountant are two distinct branches of accounting that serve different purposes. While financial accounting focuses on the preparation of public financial statements, tax accounting prioritizes tax considerations over the presentation of financial statements. Let’s explore the key differences between tax accountant and financial accountant:

Objectives

Financial accounting is an important branch of accounting that has an immense impact on businesses. Its primary purpose is to provide accurate and transparent financial information to external stakeholders, such as investors, creditors, and regulatory authorities. This information helps these stakeholders make informed decisions regarding the financial health of a company.

Financial accounting involves recording, summarizing, and presenting financial transactions in the form of financial statements. These statements include balance sheets, income statements, and cash flow statements, which provide a clear picture of a company’s financial performance and position. Tax accounting, on the other hand, is a specialized field of accounting that is concerned with meeting tax obligations. It involves tracking tax-related transactions, calculating tax liabilities, and ensuring compliance with tax laws and regulations.

Tax accountants work closely with businesses to help them prepare and file tax returns, claim tax credits and deductions, and minimize tax liabilities. Unlike financial accounting, tax accounting is primarily focused on meeting legal requirements and reducing tax liabilities.

Regulations

Financial accounting and Tax accountant are two distinct methods of accounting that are used to manage and report financial information. Financial accounting is based on generally accepted accounting principles (GAAP), which are a set of standardized principles, standards, and procedures used for financial reporting.

GAAP provides a framework for companies to record and report their financial activities in a consistent manner, enabling stakeholders to compare financial information across different entities. On the other hand, tax accounting is focused on the specific rules and regulations outlined in the Internal Revenue Code. Tax accounting is used to calculate and report a company’s tax liability to the government.

Tax laws are complex and subject to frequent changes, so tax accountants must stay up-to-date on current regulations and adjust their practices accordingly. Unlike financial accounting, which is concerned with providing a comprehensive view of a company’s financial situation, tax accounting is primarily focused on minimizing a company’s tax liability while remaining compliant with applicable laws and regulations.

Timing of Recognition

In financial accounting, revenue and expenses are recognized according to the accrual basis. This means that transactions are recorded when they occur, regardless of when the money is actually exchanged. This method provides a more accurate representation of a company’s financial position by matching revenue and expenses to the period in which they were incurred.

On the other hand, tax accountant may use either the accrual basis or the cash basis. The cash basis records transactions when the money is received or paid, while the accrual basis records transactions when they occur. The choice of method depends on a variety of factors, including the size of the business, the nature of its operations, and the regulatory requirements in the relevant jurisdiction. Despite the potential differences in accounting methods, both financial and tax accounting aim to provide an accurate picture of a company’s financial performance and position.

Inventory Valuation

One notable difference between tax accounting and financial accounting is the valuation of inventory. For financial accounting purposes, companies may use methods like the first-in-first-out (FIFO) or last-in-first-out (LIFO) to record inventory. However, for tax purposes, different methods may be employed, leading to potential differences in tax liabilities.

Tax Accounting for Individuals

Tax accountant for individuals focuses on managing the tax obligations of individual taxpayers. It involves tracking income from various sources, such as salaries, investments, and rental properties. Individuals must also consider qualifying deductions, such as mortgage interest, charitable contributions, and education expenses, to reduce their taxable income. Additionally, any investment gains or losses must be accurately reported for tax purposes.

While it is not legally required for individuals to hire a tax accountant, many individuals choose to do so to ensure accurate tax calculations, claim all eligible deductions, and maximize their tax savings. Tax accountants can navigate the complexities of tax laws and provide valuable advice on tax planning strategies.

Tax Accounting for Businesses

Tax accounting for businesses is more intricate than individual tax accounting due to the additional complexities of business finances. Businesses must track their earnings, expenses, and investments to accurately calculate their tax liabilities. They must also comply with specific tax regulations that apply to their industry and business structure.

Business tax accountants play a vital role in helping businesses manage their tax obligations. They ensure that businesses properly report their income, claim all eligible deductions, and adhere to tax laws and regulations. By identifying tax-saving opportunities and optimizing tax strategies, tax accountants help businesses minimize their tax liabilities and maximize their after-tax profits.

Tax Accounting for Tax-Exempt Organizations

Even tax-exempt organizations are required to engage in tax accountant. These organizations must file annual returns to provide information about their incoming funds, such as grants or donations, and how those funds are utilized. Tax accountant for tax-exempt organizations ensures compliance with tax laws and regulations governing the proper operation of these entities.

Tax accountants help tax-exempt organizations navigate the complexities of tax reporting and ensure accurate and timely submission of required tax documents. By properly managing their tax accounting, tax-exempt organizations can maintain their tax-exempt status and fulfill their financial reporting obligations.

Benefits of Tax Accounting

Tax accounting offers several benefits to individuals, businesses, and organizations. Let’s explore some of the key advantages:

Tax Savings

One of the primary benefits of tax accounting is the potential for tax savings. Tax accountants are well-versed in tax laws and regulations and can identify opportunities for deductions, credits, and incentives that individuals and businesses might overlook. By maximizing these benefits, tax accountants help minimize overall tax liabilities, resulting in potential cost savings.

Accuracy and Compliance

Tax accounting ensures accurate and timely preparation of tax returns, which is essential for compliance with tax laws. Tax accountants have expertise in navigating complex tax codes and regulations, reducing the risk of errors that could lead to penalties or audits. By properly tracking and reporting tax-related transactions, individuals and businesses can avoid costly mistakes and maintain compliance with tax laws.

Strategic Planning

Tax accountants provide valuable insights into long-term financial planning and decision-making. They help individuals and businesses structure their finances and operations in a way that optimizes tax efficiency. By considering tax implications in financial decision-making processes, individuals and businesses can achieve better financial outcomes and improve their overall wealth management.

Audit Support and Representation

In the event of an audit or tax-related inquiry from tax authorities, having a tax accountant can provide peace of mind. Tax accountants can represent individuals, businesses, and organizations during audits, help gather the required documentation, and navigate the audit process effectively. Their expertise and knowledge of tax laws and regulations can help resolve issues and minimize potential financial repercussions.

How to Start a Career in Tax Accounting

If you are interested in pursuing a career in tax accounting, here are some steps you can take to get started:

Obtain the Required Education

A bachelor’s degree in accounting or a related field is typically required to become a tax accountant. Some employers may prefer candidates with a master’s degree in accounting or taxation. Completing relevant coursework in tax accounting, financial accounting, and tax law can provide a strong foundation for a career in tax accounting.

Pursue Professional Certifications

Obtaining professional certifications can enhance your credibility and marketability as a tax accountant. The most recognized certification for tax accountants in the United States is the Certified Public Accountant (CPA) designation. Becoming a CPA requires passing the CPA exam and meeting specific experience and education requirements.

Gain Practical Experience

Internships and entry-level positions in accounting firms or corporate tax departments can provide valuable hands-on experience in tax accounting. Look for opportunities to work with experienced tax professionals and gain exposure to various tax accountant tasks, such as tax return preparation, tax planning, and tax research.

Stay Updated on Tax Laws and Regulations

Tax laws and regulations are constantly changing, so it’s essential to stay updated on the latest developments in tax accounting. Attend seminars, workshops, and conferences to enhance your knowledge and keep abreast of any changes that may impact your tax accounting practice.

Consider Continuing Education

Continuing education is important in the field of tax accounting to stay current with evolving tax laws and regulations. Many professional organizations offer continuing education courses and programs specifically tailored to tax accountants. Taking advantage of these opportunities can help you maintain your professional skills and stay competitive in the industry.

Frequently Asked Questions

What is the difference between tax accounting and financial accounting?

Tax accounting focuses on the preparation of tax returns and the calculation of tax payments, prioritizing tax considerations. Financial accounting, on the other hand, is concerned with the preparation of public financial statements and provides transparent financial information to external stakeholders.

Do individuals need to hire a tax accountant?

Hiring a tax accountant is optional for individuals. While individuals can manage their own tax accounting, hiring a tax accountant can ensure accurate tax calculations, claim all eligible deductions, and maximize tax savings.

How does tax accounting benefit businesses?

Tax accounting helps businesses manage their tax obligations, identify tax-saving opportunities, and optimize tax strategies. By minimizing tax liabilities, businesses can maximize their after-tax profits and improve their financial performance.

What are some common types of tax accounting?

Some common types of tax accounting include individual tax accounting, business tax accounting, and tax accounting for tax-exempt organizations. Each type serves specific purposes in managing tax obligations for different entities.

What are the career prospects for tax accountants?

The demand for tax accountants is expected to remain strong as tax laws and regulations continue to evolve. Tax accountants can find employment in accounting firms, corporate tax departments, government agencies, and consulting firms.

Conclusion

Tax accounting is a specialized branch of accounting that plays a vital role in managing tax obligations for individuals, businesses, and tax-exempt organizations. It involves the preparation of tax returns, the calculation of tax payments, and the adherence to tax laws and regulations. By understanding the different types of tax accounting, the distinctions between tax accounting and financial accounting, and the benefits of tax accounting, individuals and businesses can effectively navigate the complexities of tax compliance and optimize their tax strategies. Whether you choose to manage your own tax accountant or seek the assistance of a tax accountant, staying informed and proactive in tax matters is crucial for financial success and compliance.

Also Read : What is Cost Accounting? Definitions, Types, and Key Insights!