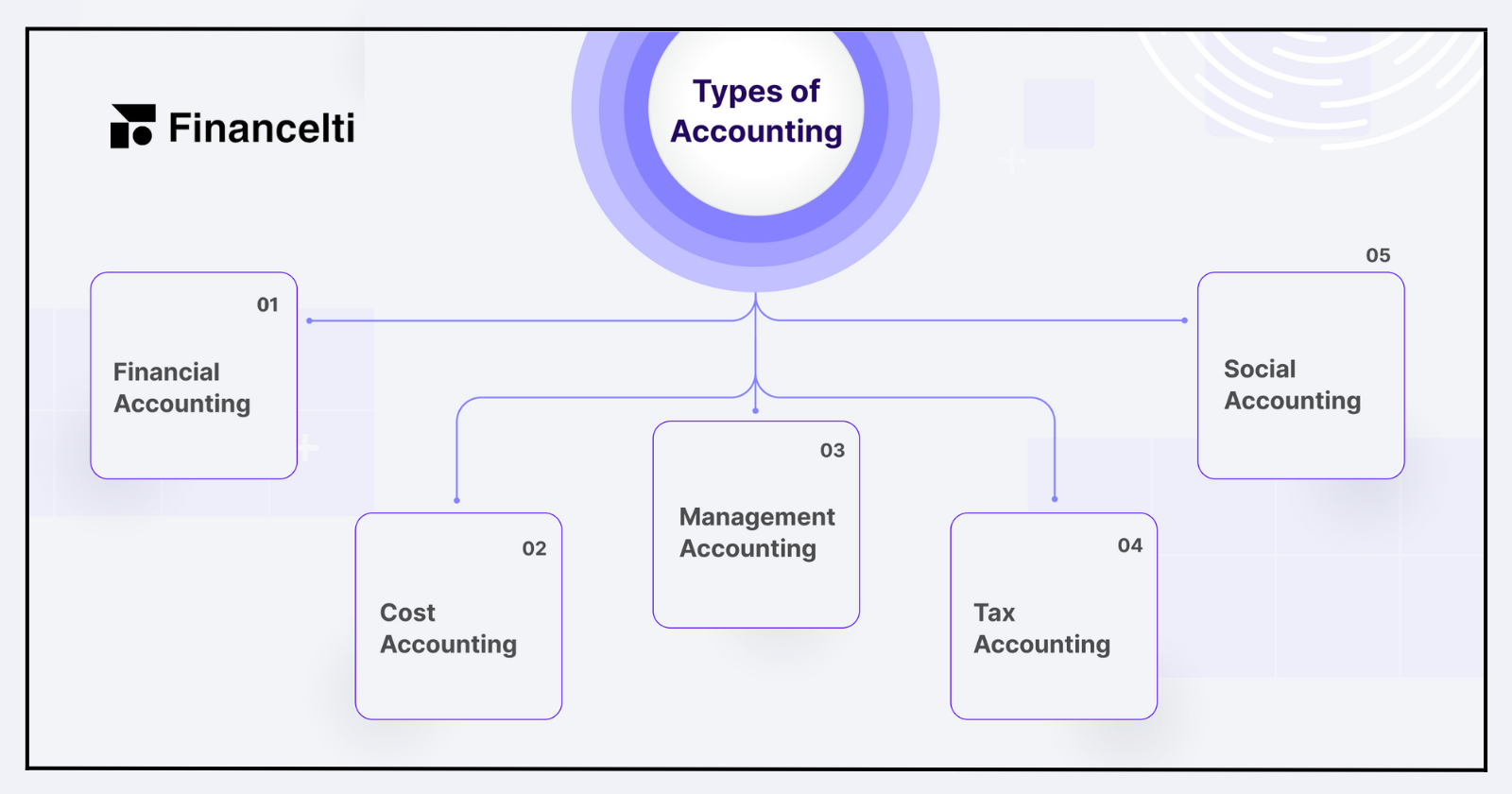

7 Types of Accounting ! In the world of business, accounting plays a crucial role in keeping track of financial transactions, analyzing data, and providing valuable insights to make informed decisions. However, accounting is not a one-size-fits-all concept. There are various types of accounting, each serving a specific purpose and catering to different needs within an organization. In this comprehensive guide, we will explore the different types of accounting, including financial accounting, managerial accounting, cost accounting, tax accounting, forensic accounting, governmental accounting, international accounting, auditing, public accounting, and fiduciary accounting. So, let’s dive in and understand the nuances of each type. Read More.

Table of Contents

Financial Accounting

Financial accounting is perhaps the most well-known and widely practised type of accounting. It involves the systematic recording, summarizing, and reporting of a company’s financial transactions. The primary objective of financial accounting is to provide accurate and reliable financial information to external stakeholders, such as investors, creditors, and regulatory authorities.

Financial accountants adhere to established accounting standards, such as the Generally Accepted Accounting Principles (GAAP) or the International Financial Reporting Standards (IFRS), to ensure consistency and comparability in financial statements. These statements, including the balance sheet, income statement, and cash flow statement, provide a comprehensive view of a company’s financial performance and position.

The importance of financial accounting cannot be overstated. It enables investors to make informed decisions about investing in a company’s stocks or bonds. Creditors rely on financial statements to assess a company’s creditworthiness and determine whether to extend credit. Regulatory authorities, such as the Securities and Exchange Commission (SEC), use financial statements to monitor compliance with reporting requirements.

Managerial Accounting

While financial accounting focuses on providing information to external stakeholders, One of the Types of Accounting – managerial accounting is geared towards internal decision-making. Managerial accountants collect, analyze, and interpret financial data to assist managers in making strategic business decisions.

The primary goal of managerial accounting is to provide managers with timely and relevant information to support planning, budgeting, and performance evaluation. This includes cost analysis, revenue analysis, budgeting, forecasting, and variance analysis.

Managerial accountants work closely with managers to identify areas of improvement, optimize resource allocation, and evaluate the financial impact of different business strategies. By providing valuable insights into costs, revenues, and profitability, managerial accounting helps companies stay competitive and achieve their financial objectives.

Cost Accounting

Cost accounting is a specialized branch of managerial accounting that focuses on analyzing and controlling a company’s costs. It involves tracking and allocating costs to various activities, products, or services within an organization.

Cost accountants play a crucial role in calculating the cost of producing goods or services, identifying cost drivers, and analyzing cost behaviour. By understanding the cost structure of a business, companies can make informed decisions about pricing, resource allocation, and cost reduction strategies.

Different cost accounting methods, such as job costing, process costing, and activity-based costing, are used to allocate costs accurately. Cost accountants also prepare cost reports, variance analyses, and other financial statements to provide valuable insights into a company’s cost performance.

Tax Accounting

Tax accounting is a specialized field that focuses on complying with tax laws and regulations in Types of Accounting. Tax accountants help individuals and businesses navigate the complex landscape of tax codes and ensure accurate and timely tax filings.

Tax accountants stay updated with the latest tax laws and regulations to maximize tax benefits and minimize tax liabilities for their clients. They assist in preparing tax returns, calculating taxes owed, and identifying tax planning opportunities.

By leveraging their expertise in tax laws, tax accountants help individuals and businesses optimize their tax positions while ensuring compliance with applicable regulations. They play a crucial role in helping companies avoid penalties and legal issues related to tax matters.

Forensic Accounting

Forensic accounting combines accounting, auditing, and investigative skills to uncover financial fraud, embezzlement, and other financial irregularities. Forensic accountants are often called upon to investigate financial crimes and provide expert testimony in legal proceedings.

These specialized accountants analyze financial records, reconstruct transactions, and identify discrepancies or fraudulent activities. They work closely with law enforcement agencies, attorneys, and other professionals to gather evidence and build a case.

Forensic accountants also provide litigation support, helping attorneys understand complex financial matters and presenting financial evidence in a clear and compelling manner. Their expertise is invaluable in uncovering financial wrongdoing and assisting in legal proceedings.

Governmental Accounting

Governmental accounting is the branch of accounting that focuses on financial management and reporting in the public sector. Government accountants are responsible for managing and tracking funds allocated for public services, such as education, healthcare, and infrastructure.

Government accounting follows specific accounting standards, such as the Governmental Accounting Standards Board (GASB) guidelines, to ensure transparency and accountability. These accountants prepare financial statements, budget reports, and compliance reports for government entities.

Government accountants play a critical role in managing public funds, ensuring efficient resource allocation, and complying with legal and regulatory requirements. Their work helps maintain fiscal discipline and transparency in government operations.

International Accounting

As businesses expand globally, international accounting becomes increasingly important. International accountants help companies navigate the complexities of accounting standards, taxation, and reporting requirements in different countries.

International accounting follows the International Financial Reporting Standards (IFRS) developed by the International Accounting Standards Board (IASB). These standards provide a common framework for financial reporting and ensure consistency and comparability across borders.

International accountants assist companies in understanding and complying with international accounting standards, managing foreign currency transactions, and addressing cross-border tax issues. Their expertise is crucial for companies operating in multiple countries and facing diverse regulatory environments.

Auditing

Auditing is an independent and systematic examination of an organization’s financial records, processes, and internal controls. The goal of auditing is to provide assurance on the accuracy, reliability, and integrity of financial information.

Auditors, both internal and external, review financial statements, perform tests, and verify compliance with accounting standards and regulatory requirements. They assess the effectiveness of internal controls and identify potential risks or weaknesses in financial reporting.

Auditing plays a vital role in maintaining trust and confidence in financial systems. It provides assurance to stakeholders, such as investors, creditors, and regulators, that financial statements are prepared in accordance with applicable accounting standards and reflect the true financial position of the organization.

Public Accounting

Public accounting refers to the practice of providing accounting services to clients on a fee basis. Public accountants work for accounting firms and offer a wide range of services, including auditing, tax preparation, financial consulting, and advisory services.

These accountants serve a diverse client base, including individuals, businesses, non-profit organizations, and government entities. They help clients with financial statement preparation, tax planning, compliance with regulatory requirements, and strategic financial decision-making.

Public accountants are often certified professionals, such as Certified Public Accountants (CPAs), who have met rigorous educational and experience requirements. They provide valuable financial expertise and guidance to clients, helping them achieve their financial goals.

Fiduciary Accounting

Fiduciary accounting focuses on managing and reporting the financial affairs of individuals or entities acting in a fiduciary capacity. Fiduciaries, such as trustees, executors, or guardians, are entrusted with the responsibility of managing assets and making financial decisions on behalf of others.

Fiduciary accountants ensure compliance with legal and ethical obligations, maintain accurate records of financial transactions, and prepare financial statements for beneficiaries or interested parties. They play a critical role in safeguarding the interests of those who are unable to manage their own financial affairs.

Fiduciary accounting requires a deep understanding of legal and regulatory requirements, as well as ethical considerations. Fiduciary accountants must act in the best interests of their clients and ensure transparency and accountability in financial matters.

Conclusion

In conclusion, encompasses various Types of Accounting, each serving a specific purpose within an organization. Financial accounting provides external stakeholders with a clear picture of a company’s financial performance and position. Managerial accounting supports internal decision-making by providing valuable insights into costs, revenues, and profitability. Cost accounting focuses on analyzing and controlling costs within a company. Tax accounting ensures compliance with tax laws and identifies tax planning opportunities. Forensic accounting investigates financial fraud and irregularities. Governmental accounting manages public funds and ensures transparency in government operations. International accounting helps companies navigate international accounting standards and regulatory requirements.

Auditing provides assurance on the accuracy and reliability of financial information. Public accounting offers a range of accounting services to clients. Fiduciary accounting manages financial affairs in a fiduciary capacity.

By understanding the different types of accounting and their respective roles, businesses can make informed decisions, comply with regulations, and achieve financial success.

FAQs

What are the main types of accounting?

The main types of accounting include financial accounting, managerial accounting, cost accounting, tax accounting, forensic accounting, governmental accounting, international accounting, auditing, public accounting, and fiduciary accounting.

What is the difference between financial accounting and managerial accounting?

Financial accounting focuses on providing financial information to external stakeholders, while managerial accounting provides internal information for decision-making and planning.

How does forensic accounting help in detecting financial fraud?

Forensic accounting combines accounting and investigative skills to uncover financial fraud, embezzlement, and other financial irregularities. Forensic accountants analyze financial records, reconstruct transactions, and provide expert testimony in legal proceedings.

What is the role of governmental accounting?

Governmental accounting focuses on financial management and reporting in the public sector, ensuring transparency and accountability in the use of public funds.

How does international accounting differ from other types of accounting?

International accounting deals with accounting standards, taxation, and reporting requirements in different countries, helping companies navigate diverse regulatory environments.

What is fiduciary accounting?

Fiduciary accounting involves managing and reporting the financial affairs of individuals or entities acting in a fiduciary capacity, such as trustees, executors, or guardians.

How does cost accounting help in managing costs within a company?

Cost accounting analyzes and allocates costs to various activities, products, or services within a company, helping identify cost drivers, analyze cost behaviour, and make informed decisions about pricing and cost reduction strategies.

Also Read : Accounting Basics Guide: Defination, Meaning, And Types of Accounting.